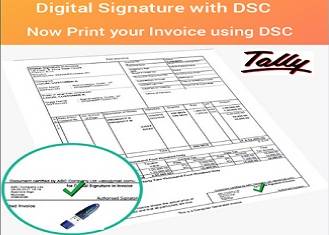

Digital Signature in Tally

As India, growing day by day with digitization it’s our turn to digitalise our clients and their books by using Digital Signature on Invoice. Studies have shown that the total cost of manual paper invoicing can be much higher than e-invoicing. e-Invoicing can save costs, time and efforts. The Indian Union Budget 2015-16 has allowed Invoices, Challans, and Consignment notes etc., to be digitally signed with digital signature certificates and sent to customers electronically. Digital Signature is very popular among users post GST and now it is mostly required in GST, TDS and other important taxation systems.

As India, growing day by day with digitization it’s our turn to digitalise our clients and their books by using Digital Signature on Invoice. Studies have shown that the total cost of manual paper invoicing can be much higher than e-invoicing. e-Invoicing can save costs, time and efforts. The Indian Union Budget 2015-16 has allowed Invoices, Challans, and Consignment notes etc., to be digitally signed with digital signature certificates and sent to customers electronically. Digital Signature is very popular among users post GST and now it is mostly required in GST, TDS and other important taxation systems.

As per the regulations for invoicing, an invoice can be authenticated by means of a digital signature. You can digitally sign your invoices from / within Tally software anytime, at just click of the button and easily transfer, store and retrieve signed documents. You can also export digitally signed Tally Invoices in PDF format, which can further be shared via email.

Benefits of Digitally Signing Invoices

- Digital Signatures can protect the authenticity and integrity of archived data

- Big Corporate Offices prefer Digitally Signed Invoices over Print Copies

- Electronic and Digital signatures are as authentic as hand written signatures

- Electronic documents can be immediately delivered to recipients over email

- Companies can have integrated workflow. Signing, transfer, processing of electronic documents can happen within the system itself.

- Digital signatures provide green, environment friendly alternative to pape

Digitally Signed – GST Compliant Invoices

Digital Signature Certificate (DSC) is a means of electronically signing documents to verify the authenticity of the person signing. It can be substituted for a physical handwritten signature. DSC is valid only if it created as per the provisions laid down under the Information Technology Act.

As part of Goods and Services Tax (GST) regulations in India, all GST filings that include forms and invoices are required to be digitally signed. This makes digital signatures compulsory for e-filing of income tax returns, e-filing for a Registrar of Companies, online auctions (like e-tenders), challans, consignment notes, delivery orders, etc.

Offer Highlights

- Unlimited Telephonic Support & Remote Support via Team Viewer will be provided from the date of Installation.

- Configuration of customized solution as per system details given by you.

- Multiple DSC token accepted.

- One time purchase & much more…